Queue Positions and the Price of Eggs: More Alike Than You Think

An Egg-spensive introduction:

Incoming: another obscure analogy from the Pearl Street team, this time linking the concept of scarcity to both eggs and interconnection queue positions.

Scarcity in economics is when the demand for a good or service exceeds its supply. Consider the current state of egg prices. Because of the widespread bird flu, far fewer eggs are available for public consumption. So much so that many retailers have instituted their own “caps” on how many cartons an individual can purchase. This mismatch in supply and demand (among other levers) has caused egg prices to soar, with the USDA forecasting a more than 20% price increase in 2025.

MISO’s new queue cap:

Unlike eggs, interconnection queue positions aren’t an everyday commodity, but they will be a limited resource starting Fall 2025 for MISO’s next DPP cycle.

Why the cap? Like other US grid operators, MISO has received an unprecedented volume of interconnection applications, which has made it challenging to create accurate models to study the new generation. In turn, unrealistic modeling assumptions are made, producing study results with likely unrealistic network upgrades and associated costs.

Because interconnection customers receive estimates that can be difficult to predict, many enter speculative projects into the queue as a price-finding mechanism and withdraw after seeing exorbitant initial network upgrade costs. While this is a necessary evil for developers, it negates much of the work done by MISO to provide initial estimates because many of the corresponding upgrades also disappear… Vicious cycle? We think yes.

So, MISO proposed a queue cap that aims to:

- Reduce speculative requests,

- Improve processing times,

- Minimize cost estimate volatility,

- Enhance compliance with study cycle timing,

- And provide more accurate impact assessments.

But how will it actually play out?

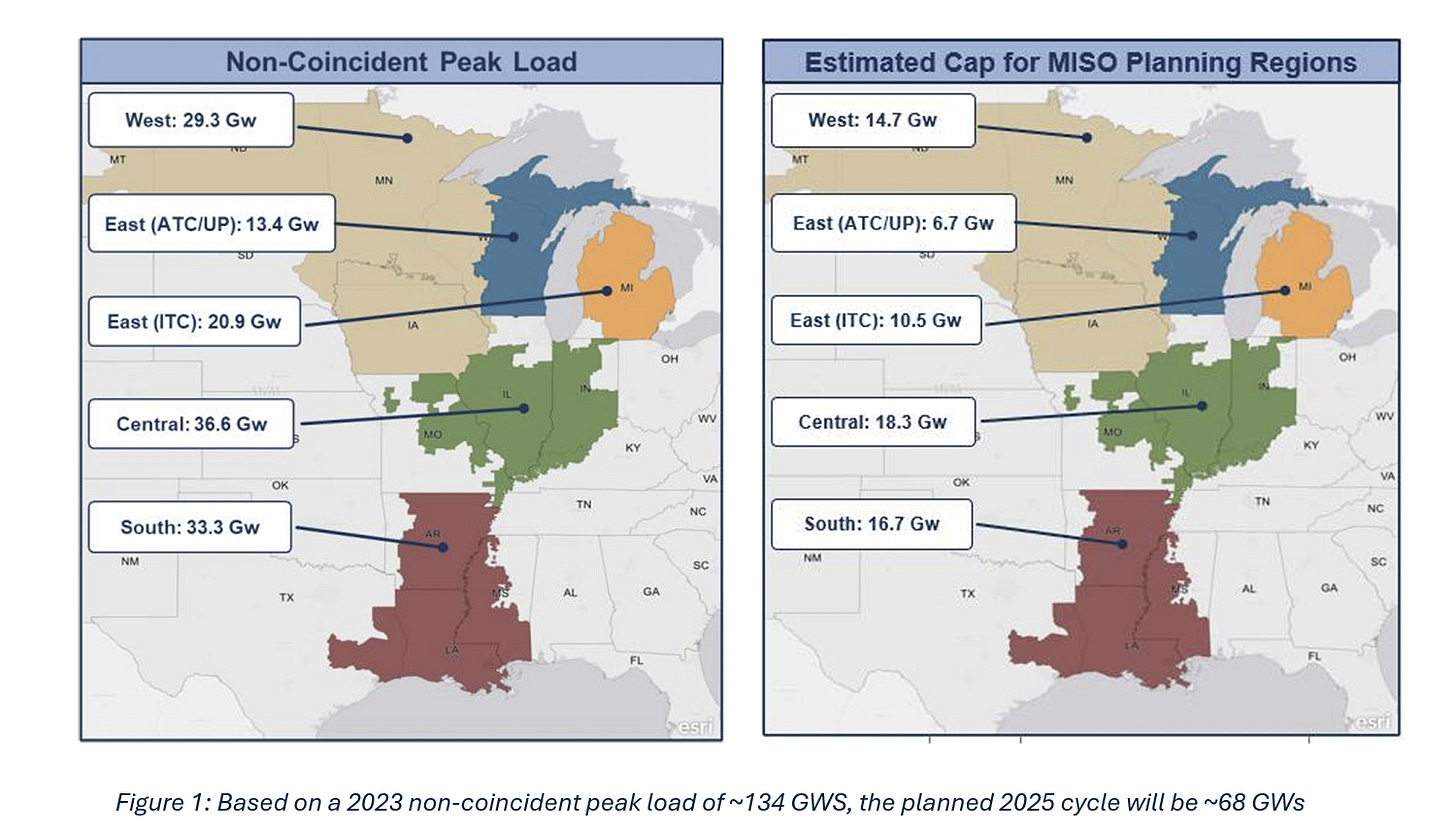

After more than a year of trying to implement a queue cap, FERC gave MISO its stamp of approval in January 2025. The cap will be set at 50% of the non-coincident peak value from the latest transmission expansion planning model. For the 2024 cycle, this is estimated at around 68 GW.

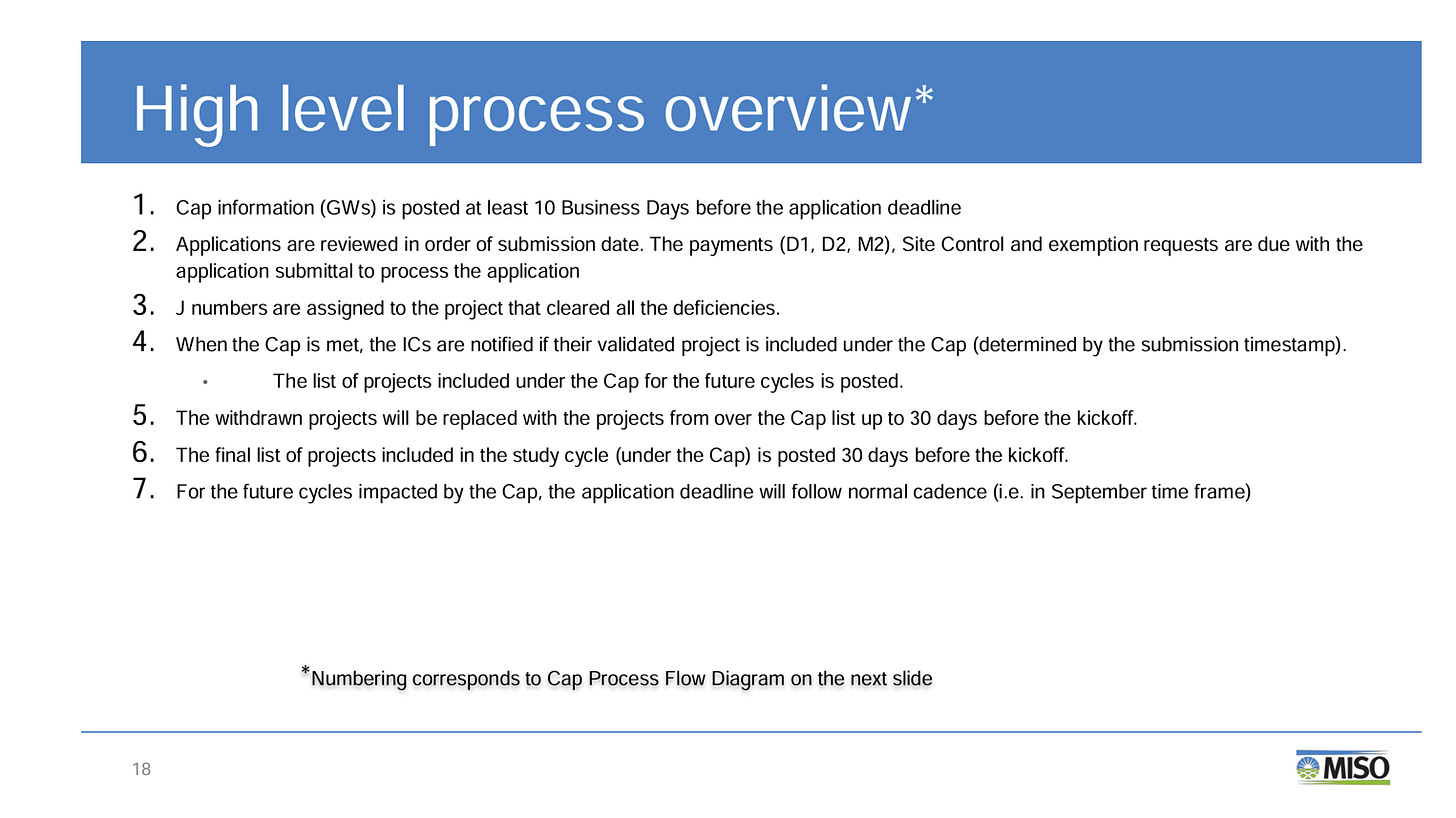

Based on guidance from a recent IPWG meeting, we expect MISO will follow the steps outlined below, but as this is a new process, we encourage you to be on the lookout for official updates.

Once the cap is set, MISO will post the cap information and start accepting applications; the order of submission date will be crucial, and applications will need to post security payments and provide site control and/or exemption requests. Interconnection customers will be informed whether their project is included in the cap, and projects exceeding the cap will roll over to the next cycle. A final list of projects within the cap will be provided, and MISO will kick off the study.

Navigating the queue cap as an interconnection customer:

Back to scarcity. With the cap in place, queue positions will be more valuable if there are fewer of them in any given year. Take DPP-2023-Phase 1, which contains 123 GW of proposed generating capacity. Yet, if everything goes to plan with the queue cap, the 2024 cycle will max out at 68 GW, a 44% decrease from 2023.

The impending scarcity of queue positions will likely cause some interesting dynamics. While scarcity can affect price, it can also influence decision-making. With eggs, consumers must choose between stomaching the increased cost or purchasing a substitute. Unfortunately, others will try to circumvent the decision and resort to illegal activities. Case and point: “egg heists,” such as the recent theft of 100,000 eggs from a distribution trailer in Pennsylvania.

It’s not going to be as easy for interconnection customers to pull off a queue position heist. However, interconnection customers will have to ask many questions as they prepare for MISO’s queue cap. For instance:

- Will fewer projects withdraw from MISO’s final uncapped cycles (DPP 2022 with a Phase 1 decision point coming soon, and DPP 2023 pre-screen and Phase 1 decision points shortly thereafter) because securing a DPP 2025 spot will be harder?

- Eggs-ample: if you had known how scarce eggs would become, would you have perhaps savored that burnt omelet you made in January a bit more?

- In general, will there be fewer early-stage withdrawals to take a gamble on what happens in phase 2 as costs shore up?

- Eggs-ample: if you bite the bullet and buy a $10 carton of eggs, would you perhaps stretch them out longer so you can wait and see if prices go down?

- Will a hotter M&A market exist for queue positions even earlier in the lifecycle to secure a project with an earlier COD?

- Eggs-ample: if you’re one of those people buying stores out of their egg stock early in the morning, and your hungry neighbor is just desperately hankering for a breakfast hash, might you re-sell them your eggs with a healthy markup? (price gouging cough cough)

Interconnection customers will need to conduct thorough scenario analyses to navigate these changes effectively, considering not just immediate costs but also long-term project viability and queue position availability.

Conclusion:

MISO’s queue cap is designed to streamline study processes and provide more accurate cost estimates. For interconnection customers, strategic planning and scenario analysis will be key to successfully navigating this new landscape, potentially aided by tools like Interconnect®.